We are a full-service payroll company based in Tulsa, OK, but we provide support for all 50 states + D.C. and Puerto Rico.

We file your W-2 forms at the end of every year, and provide them to each of your employees in their individual online portals.

Who wants more paper? We process your payroll, email you reports, and provide online access to your tax forms, all within a secure environment.

You will have a payroll expert assigned to your account that truly cares. Our people love working here, so you won’t be assigned a new specialists every 3 months.

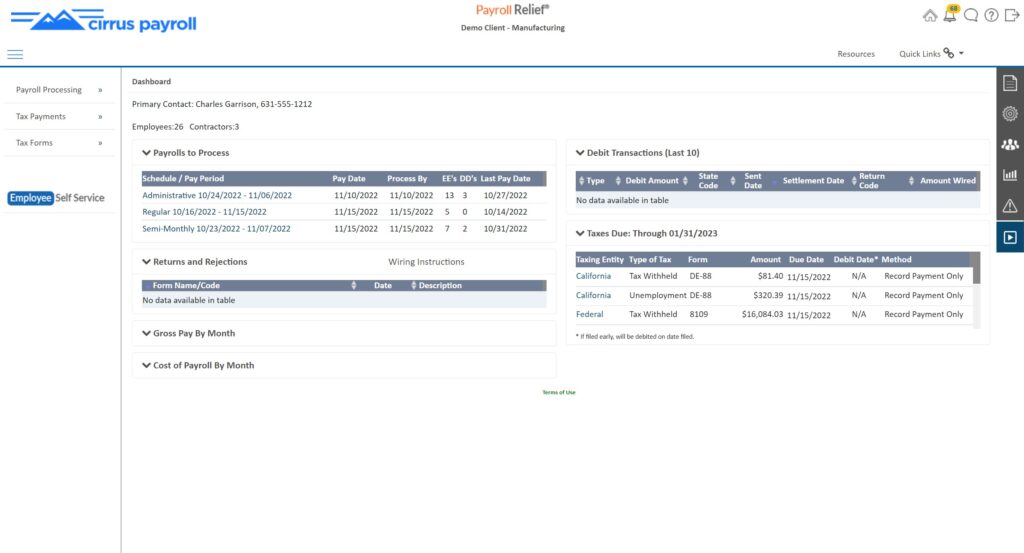

Payroll reports will be emailed to you after each payroll is processed. In addition, you will have access to dozens of reports within your online client portal.

We will ensure your payroll is calculated correctly, file all your state and federal payroll tax forms, and deposit your tax liabilities. On-time, guaranteed.

We calculate all types of garnishments, and provide electronic garnishment services for child support.

Direct deposit services are always included for no additional charge.

We can track accruals and usage of hours for Vacation, Sick, and PTO policies. Employees’ time-off balances are conveniently displayed on their pay stubs.

All states require that new hires are reported to the new hire registry. We handle this reporting process for you.

Employee have their own individualized logins to view pay stubs and W-2s at their convenience.

Our payroll platform powerfully integrates with a suite of other services, including pay-as-you-go workers comp and time & attendance. We also integrate with both QuickBooks Desktop and QuickBooks Online.