An EFTPS (Electronic Funds Transfer Payment System) Inquiry Pin is a 4-digit number the IRS issues to employers who use a payroll tax service to manage their payroll tax deposits. It allows you to log into the EFTPS to see what federal tax payments have been made and when. This is important, because businesses that use payroll services are still liable for any late or missed payments even though their provider is handling the process.

To make paying your payroll taxes easier, consider signing up with us at Cirrus Payroll. We not only file and pay your federal taxes; all state and local taxes are covered too. We make sure your taxes are paid the right way and on time. Get a quote to learn more.

How the EFTPS Inquiry Pin Works

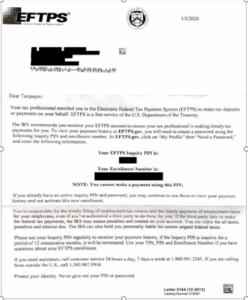

When you sign up with a new payroll company, they will file a Form 8655 Reporting Agent Authorization with the IRS. This allows the service to file tax returns on your behalf. Once the IRS processes this form,, the EFTPS Inquiry Pin will be automatically mailed to your business address on file. If you don’t receive your letter within a week or so after your provider signs you up for electronic tax payment services, call EFTPS Customer Service at 1-800-555-4477. Once you receive the letter, you’ll be able to set up your account on the EFTPS website. You’ll enter the Inquiry PIN number and enrollment number shown in the letter to log in.

Other Important Facts About the EFTPS Inquiry Pin

- Inquiry PINs allow you to view 16 months of your federal tax payment history

- You will not be able to see state or local payroll tax payments.

- The Inquiry PIN does not allow you to make tax payments yourself, only inquiries regarding payments that have been made.

- If you still have outstanding payroll tax payments from a period when you were processing payroll on your own, you should continue to use your prior EFTPS account to make those payments, unless your payroll provider agrees to submit them for you.

- Inquiry PINs that haven’t been used in 12 months will be canceled.

Key Takeaway

Although it’s your payroll provider’s job to make your federal tax payments, verifying if and when they did keeps you “in the know” on your tax liability and helps you avoid unnecessary late fees and penalties. We recommend logging into your EFTPS Inquiry account as soon as you receive your pin number and setting at least a monthly log-in reminder.

At Cirrus Payroll, we are committed to filing and paying your payroll taxes on time. If you ever incur any fines or fees due to mistakes our representatives make, we refund them in full. Sign up to learn more today.