A pay stub is a document, either electronic or paper, that shows details about an employee’s pay, such as hours worked, total wages, taxes and deductions, and net (take home) pay. It provides pay information for the current pay period and year-to-date totals, so employees can see how much they’ve earned in total for the year, as well as how much they’ve paid in taxes and other deductions. At the end of the year, these YTD amounts should align with the totals on their year-end W-2 forms.

Please note: There are no federal laws requiring that employers distribute pay stubs, but many states have their own rules. Depending on your local laws, you may be required to provide a printed or written pay statement and most give you the option to provide it electronically.

To save time from having to create your own pay stubs and to avoid printing costs, consider signing up with Cirrus Payroll. We process employee payroll each pay period, and your employees can access their pay stub information completely online. In addition, we offer direct deposit options and file and pay your taxes so you don’t incur penalties.

Information to Include in a Pay Stub

Regardless of whether you’re required to provide pay stubs (statements) or not, it is a best practice. It helps ensure employees know how their paychecks were calculated, reducing questions and conflict in the future. You can also keep a copy for your records to satisfy the Department of Labor’s recordkeeping requirement (you must keep payroll records that details each employee’s hours worked and wages paid).

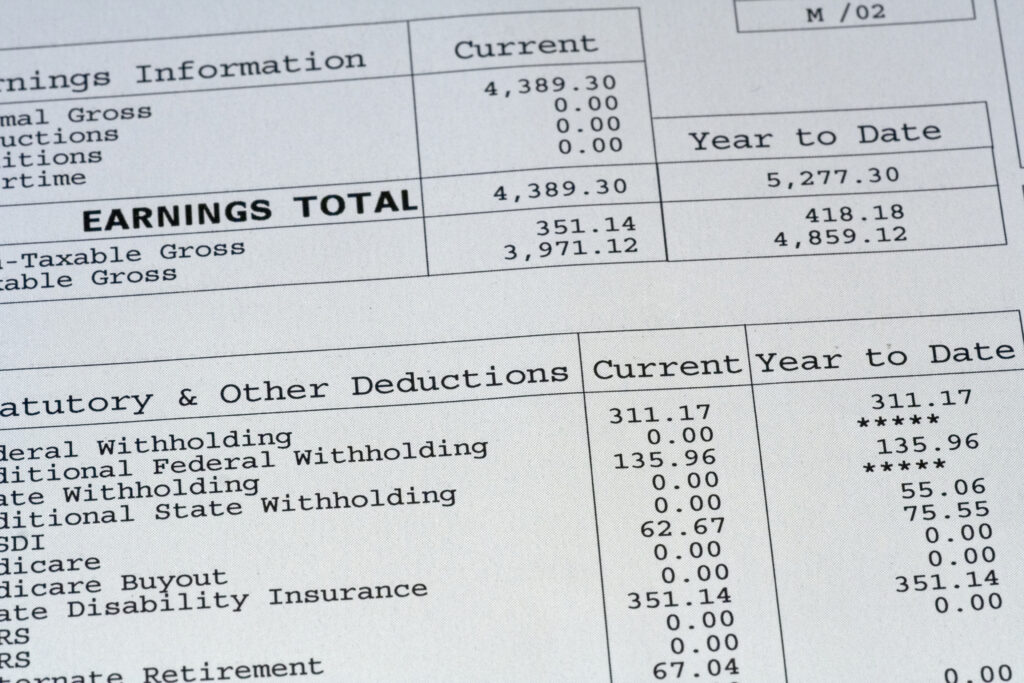

Common information most pay stubs include are:

- Employee’s name

- Employer’s address

- Pay period

- Pay date

- Total hours worked

- Pay rate

- Gross pay

- Net pay

- Social Security & Medicare Taxes withheld

- Benefit deductions

Pay stub data makes it easy to calculate and verify that each employee’s paycheck is correct. Employees can verify they received the raise they were told would take effect, that benefit premiums are being deducted accordingly, and they’re being paid for the correct period.

And ultimately, giving your employees access to their pay stub information saves you time in the long run. When they have questions about prior paychecks or need to verify their income for external reasons, you won’t have to be their go-to person. And those who want to begin their annual tax return process before receiving their official W2 form can use the details on their last pay stub for the year to file taxes instead.

2021 State Pay Stub Regulations

To see what your responsibilities are when it comes to pay stubs, find your state in the table below. Most states require pay statements but allow you to determine how you want to deliver them; however, there are nine states that don’t have any stub laws, so if you’re in one of those, you can opt not to provide them if you don’t want to.

There are a few states that allow you to choose how you want to provide pay stubs but also give employees the opportunity to opt for paper stubs even if you prefer to offer electronic ones. Hawaii is the only state that requires an employee opt-in to be able to receive an electronic stub.

| No Pay Stub Laws | Stubs Required in any Format | Written/printed Pay Stubs Only | Electronic Opt-out States | Electronic Opt-in States |

| Alabama | Alaska | California | Delaware | Hawaii |

| Arkansas | Arizona | Colorado | Minnesota | |

| Florida | Idaho | Connecticut | Oregon | |

| Georgia | Illinois | Iowa | ||

| Louisiana | Indiana | Maine | ||

| Mississippi | Kansas | Massachusetts | ||

| Ohio | Kentucky | New Mexico | ||

| South Dakota | Maryland | North Carolina | ||

| Tennessee | Michigan | Texas | ||

| Missouri | Vermont | |||

| Montana | Washington | |||

| Nebraska | ||||

| Nevada | ||||

| New Hampshire | ||||

| New Jersey | ||||

| New York | ||||

| North Dakota | ||||

| Oklahoma | ||||

| Pennsylvania | ||||

| Rhode Island | ||||

| South Carolina | ||||

| Utah | ||||

| Virginia | ||||

| West Virginia | ||||

| Wisconsin | ||||

| Wyoming |

To provide your own pay stubs, consider using Cirrus Payroll–we give your employees paperless access to all of their paycheck details. They can be paid via direct deposit, at no additional cost. We’ll also pay and file your taxes.